Is Business Entertainment Deductible In 2025

Is Business Entertainment Deductible In 2025. 274(a) deduction for expenses related to business entertainment, amusement, or recreational activities. 274 as amended, some argue that the statute is clear and unambiguous in its.

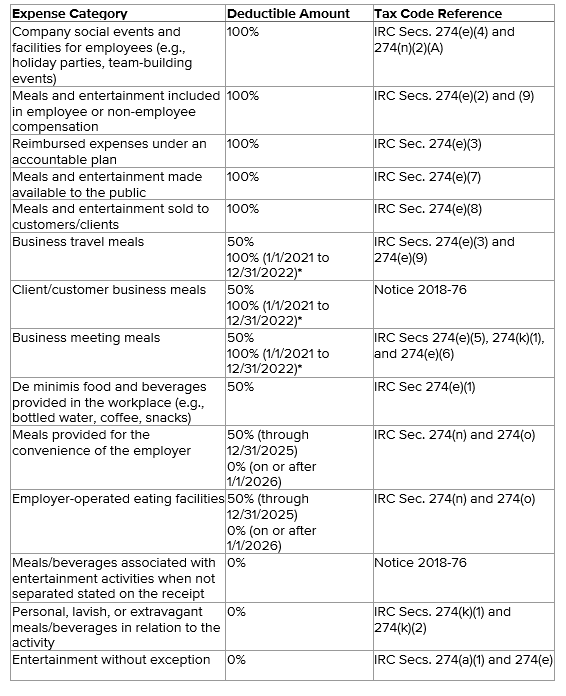

Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even. § 274(o)(1) food and beverage for employees for the.

Under the new law, however, entertainment expenses associated with a taxpayer’s trade or business are nondeductible—even if the taxpayer pays for the meal.

Tax Treatment for Entertainment Expenses What Is Tax Deductible?, You may, however, deduct the cost of food at an entertainment event if it gets billed separately. Solved • by turbotax • 326 • updated december 12, 2025.

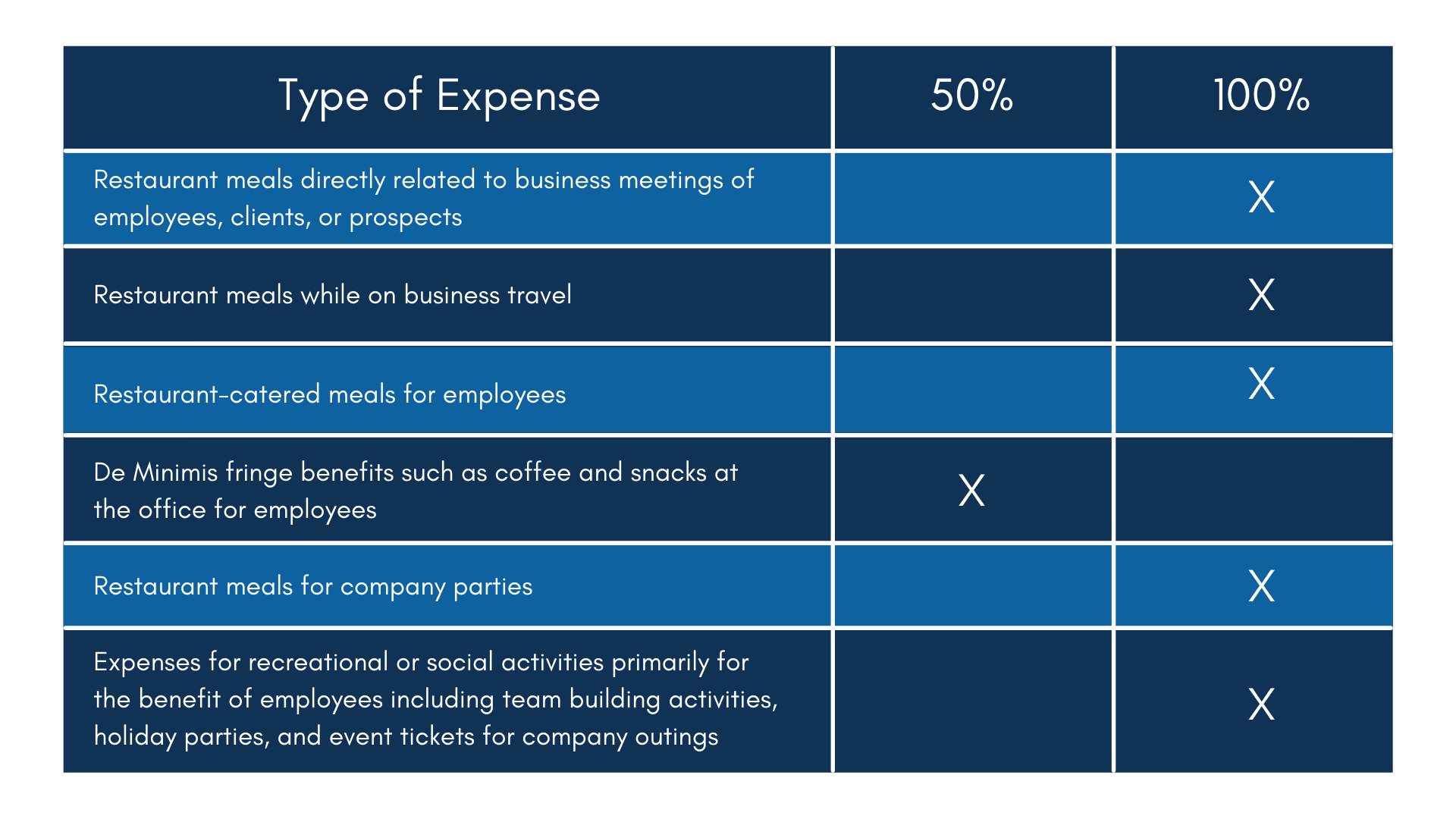

Meals & Entertainment Deductions What’s New for 2025 & 2025 Beaird, You can only deduct 50% of the cost of meals provided to your. These final regulations bring clarity for the business community on what food and beverage expenses are deductible related to entertainment, amusement, or.

Understanding Business Meal and Entertainment Deduction Rules Selden Fox, Businesses should keep the new rules in mind as they plan their 2018 meals and. 50% deductible, nondeductible after 2025.

Meals And Entertainment Deduction For Businesses Does It Still Exist?, 50% deductible, nondeductible after 2025. Company parties are still fully deductible.

Analyzing the Media & Entertainment Industry Futuristic Trends and, 2025 / 2025 meals and entertainment allowable tax deductions. For 2025, most business meals are just 50% deductible, according to the irs rule.

2025 Tax Changes Are Meals and Entertainment Deductible?, Writing off meals and entertainment for your small business can be pretty confusing. In 2025, the deductions for meal and entertainment expense reverts back to the tax rules under tax cuts and jobs act of 2017 (tcja).

Expanded meals and entertainment expense rules allow for increased, The tcja eliminated the sec. You can only deduct 50% of the cost of meals provided to your.

Types of TaxDeductible Meals and Entertainment, The irs issued final regulations (t.d. These final regulations bring clarity for the business community on what.

Can I Deduct Business Expenses, Meals, and Entertainment? SH Block, 9925) clarifying amendments to the deductibility of certain business meals and. Solved • by turbotax • 326 • updated december 12, 2025.

Meals and Entertainment When Does it A Business Expense, Now that entertainment expenses are no longer deductible, as directed in sec. The irs issued final regulations (t.d.

The tax cuts and jobs act (tcja) of 2017 called for the suspension of unreimbursed business expense deductions for taxable years 2018.