New Jersey Tax Rates 2025

New Jersey Tax Rates 2025. The salary tax calculator for new jersey income tax calculations. Estimate your 2025 shared responsibility payment.

New jersey’s effective property tax rate is. The states with the highest effective property tax rates were found to be new jersey, illinois, new.

Tax table (2018 and after returns) tax table (2017 and prior returns) if your new jersey taxable income is less than $100,000, you can use the.

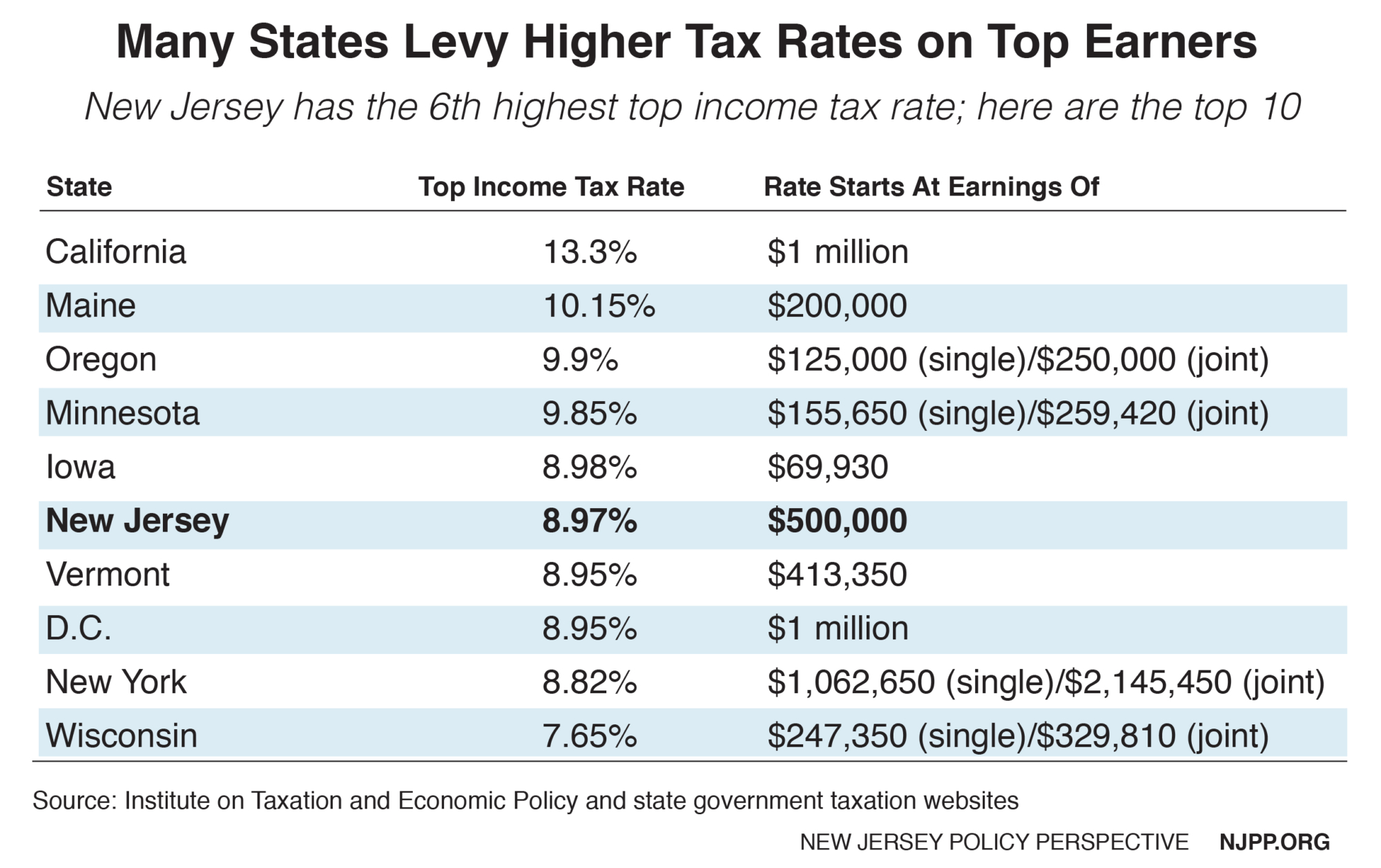

There are seven tax brackets for single filers in new jersey (eight for joint filers), ranging from 1.4 percent to 10.75 percent.

Road to Recovery Reforming New Jersey's Tax Code New Jersey, Newark imposes an added payroll tax. New jersey state income tax calculation:

Tax rates for the 2025 year of assessment Just One Lap, Estimate your 2025 shared responsibility payment. This comprises a base rate of 6.625% with no mandatory.

Road to Recovery Reforming New Jersey's Tax Code New Jersey, Top rate of 10.75% (on taxable income over $1 million). The withholding tax rates for 2025 reflect graduated rates.

Will New Jersey be Tied for Highest Corporate Tax Rate? Tax Foundation, Phil murphy’s 2025 budget offers great news in committing to sunset a 2.5% corporation business tax surcharge. 37 percent for incomes over $578,125,.

New Jersey State Taxes Taxed Right, The new jersey sales tax rate in 2025 is 6.625%. The latest state tax rates for 2025/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states.

NJ Tax Rate Haefele Flanagan, New jersey sales tax rates & calculations in 2025. Phil murphy’s 2025 budget offers great news in committing to sunset a 2.5% corporation business tax surcharge.

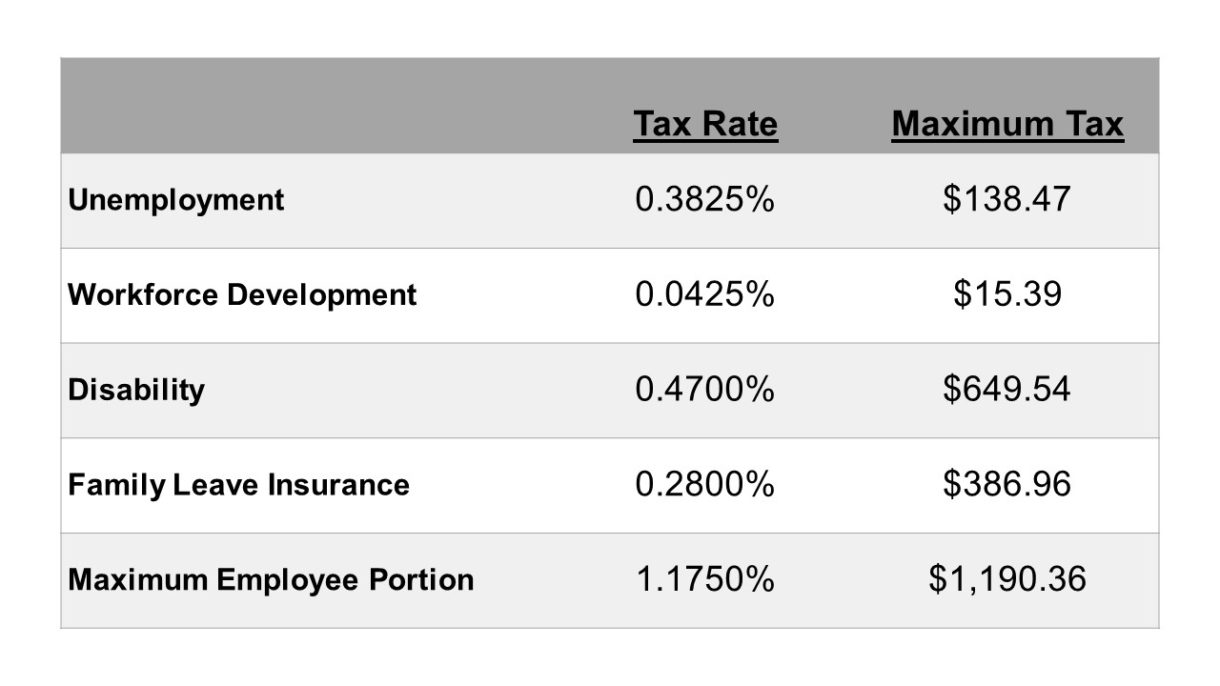

2025 New Jersey Payroll Tax Rates Abacus Payroll, The average property tax bill in new jersey increased to $9,803 last year, a $313 jump from a year earlier, according to the latest state data. The 11.8% tax rate applies.

Reforming New Jersey’s Tax Would Help Build Shared Prosperity, 2.23 percent of a home’s. Here are the 2025 tax rates, which will apply when you file taxes next year:

Reforming New Jersey’s Tax Would Help Build Shared Prosperity, This comprises a base rate of 6.625% with no mandatory. The 11.8% tax rate applies.

State Corporate Tax Rates and Brackets Tax Foundation, New jersey's 2025 income tax ranges from 1.4% to 10.75%. Calculate your income tax, social security.

Tax table (2018 and after returns) tax table (2017 and prior returns) if your new jersey taxable income is less than $100,000, you can use the.